Retail center near Mountain's Edge sold for $12.4 million

LAS VEGAS REVIEW-JOURNAL

Posted: Sep. 28, 2012 | 12:17 p.m.

The Blue Diamond Marketplace retail center has sold for $12.4 million, or $173 a square foot, one of the higher-priced bank-owned properties to be sold in recent months, Sun Commercial owner Cathy Jones said Friday.

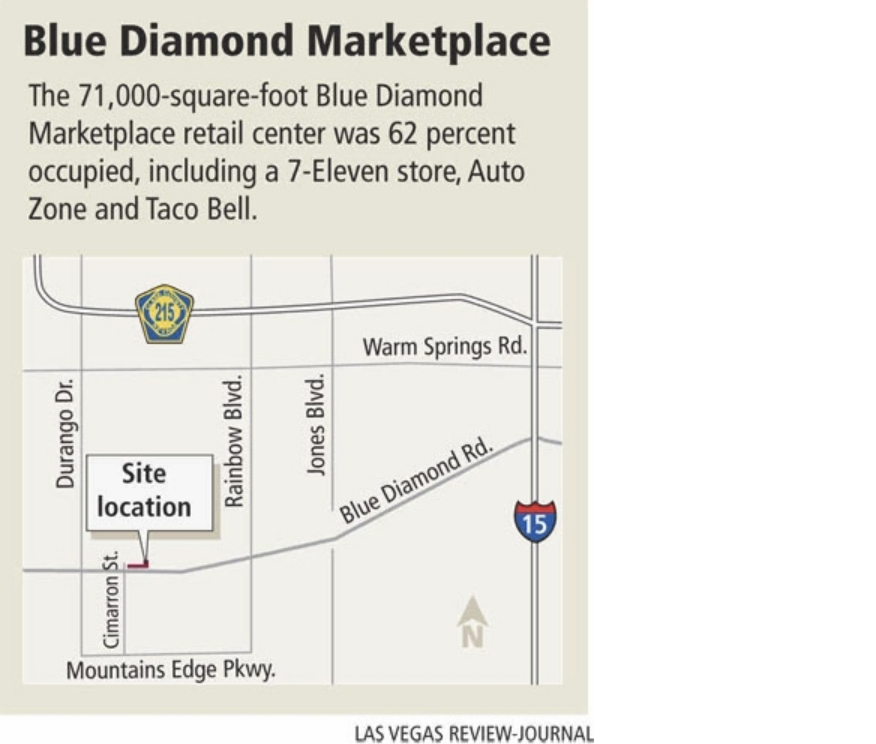

The 71,000-square-foot center near the master-planned Mountain's Edge community was 62 percent occupied, including a 7-Eleven store, AutoZone and Taco Bell.

"I think we're starting to see an uptick in properties that are in good locations," Jones said. "It's going to be a comp (comparable sale). Appraisers are going to be happy."

Jones said she's getting multiple offers on properties that have decent income. She took six offers on Blue Diamond Marketplace.

"There's more investment money coming into the market. We've seen 1031 (Exchange) money come in," she said.

A 1031 real estate exchange lets investor defer capital gains taxes on the sale of real property by exchanging it for like-kind property within 180 days.

Transaction activity in the Las Vegas office market is trending upward as sellers who've been waiting for the market to improve are trying to salvage some equity ahead of loans coming due, brokerage Marcus & Millichap reported in a third-quarter market overview of Las Vegas.

Mike Montandon, managing director of Voit Real Estate Services in Las Vegas, said the amount of investment activity has a lot to do with the total size of the investment.

"Las Vegas really isn't the mecca of institutional investment-grade properties," he said. "We've got tons of properties (priced at) under $10 million, and institutional investors are looking for something much larger. These funds literally have billions of dollars and $10 million is a small investment for them."

Brian Riffel of Colliers International said there's an uptick in pricing on some transactions. He represented City National Bank in the July sale of two buildings totaling 11,500 square feet on 2.75 acres in the Tenaya Market Place to Golden Maui for $720,000.

"It isn't anything to write home about because you don't necessarily have that much velocity, but banks are one of the more motivated sellers, depending on how long they've had the asset and their relationship with the (Federal Deposit Insurance Corp.)," Riffel said.

One significant change in the commercial market over the past several years is the gap between broker's price opinions and appraisals has closed, Voit office and industrial broker Eric Larkin said.

Larkin said he's getting a lot of interest from "speculative players" in The Park at Palisades, a 6.2-acre master-planned business park on Rancho Drive listed for $1.3 million.

"Buyers and investors feel the banks want to get the properties off their books by the end of the year. Sometimes they're right, sometimes they're wrong," Larkin said. "A lot of the initial push is over, but it's steady and going to remain a big part of our business for the foreseeable future."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.

The 71,000-square-foot center near the master-planned Mountain's Edge community was 62 percent occupied, including a 7-Eleven store, AutoZone and Taco Bell.

"I think we're starting to see an uptick in properties that are in good locations," Jones said. "It's going to be a comp (comparable sale). Appraisers are going to be happy."

Jones said she's getting multiple offers on properties that have decent income. She took six offers on Blue Diamond Marketplace.

"There's more investment money coming into the market. We've seen 1031 (Exchange) money come in," she said.

A 1031 real estate exchange lets investor defer capital gains taxes on the sale of real property by exchanging it for like-kind property within 180 days.

Transaction activity in the Las Vegas office market is trending upward as sellers who've been waiting for the market to improve are trying to salvage some equity ahead of loans coming due, brokerage Marcus & Millichap reported in a third-quarter market overview of Las Vegas.

Mike Montandon, managing director of Voit Real Estate Services in Las Vegas, said the amount of investment activity has a lot to do with the total size of the investment.

"Las Vegas really isn't the mecca of institutional investment-grade properties," he said. "We've got tons of properties (priced at) under $10 million, and institutional investors are looking for something much larger. These funds literally have billions of dollars and $10 million is a small investment for them."

Brian Riffel of Colliers International said there's an uptick in pricing on some transactions. He represented City National Bank in the July sale of two buildings totaling 11,500 square feet on 2.75 acres in the Tenaya Market Place to Golden Maui for $720,000.

"It isn't anything to write home about because you don't necessarily have that much velocity, but banks are one of the more motivated sellers, depending on how long they've had the asset and their relationship with the (Federal Deposit Insurance Corp.)," Riffel said.

One significant change in the commercial market over the past several years is the gap between broker's price opinions and appraisals has closed, Voit office and industrial broker Eric Larkin said.

Larkin said he's getting a lot of interest from "speculative players" in The Park at Palisades, a 6.2-acre master-planned business park on Rancho Drive listed for $1.3 million.

"Buyers and investors feel the banks want to get the properties off their books by the end of the year. Sometimes they're right, sometimes they're wrong," Larkin said. "A lot of the initial push is over, but it's steady and going to remain a big part of our business for the foreseeable future."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.

.png)